Guide to Reports

Budget Report

Encumbrance Summary

Funds Available for Viewing

Statement of Account (SOA)

Statement of Account Financial Summary

Summary Trial Balance

Transaction Detail

Budget Detail Report

Labor Distribution Report

Payroll Expense Report

Personnel Expenditures Report (Salary Savings)

Actual Hours Worked & Hourly Rate by Org

Employee Listing by HR Organization

Labor Distribution Report

Student Assignment Approval Listing

Get a list of your accounts via Accounts Available for Viewing report.

- MyUNIverse

- e-Business Suite Reports

- e-Business Suite References

- Accounts Available for Viewing

-select Excel or PDF format

-click Run Report

- Statement of Account (“Show Detail”)– This report provides current budget, YTD encumbrances, YTD actual expenses, and the budget variance. It features drill down capabilities for researching specific items. The Budget Report, also written in WebFOCUS, provides the current budget, YTD encumbrances, YTD actual expenses, and the budget variance, but no drill down capability.

- Transaction Detail – Get a complete listing of all account activity; especially helpful if you have several months to reconcile.

- Personnel Expenditures Report, written in Discoverer – This report is used to monitor salary and fringe benefit expenditures and salary savings. This report includes the original budget, current budget, YTD encumbrances, YTD actual expenses and a line variance for every budgeted salary line. Labor distribution adjustments and special payroll checks written are included in this report. This is the only report that provides detailed fringe benefit information by person. This Summary Report has “drill down” capability for viewing monthly detail. In the Detail Report, an individual line number is entered to view all expenses and adjustments for that specific line.

- The green bar report sent from Sponsored Programs – This is the only report to use to determine how much you have spent in the grant and what your free balances are.

- Transaction Detail – This report will provide the detail of expenses that have been charged to the grant account.

- Statement of Account Financial Summary (hint: enter only the fund # and verify all the other segments have the low value all zeroes and the high values all 9’s) – This is the only report that will provide beginning and ending balances.

- Transaction Detail – Get a complete listing of all account activity.

- Statement of Account – (hint: enter only the fund #) If you have questions about items appearing on the transaction detail, use the drill down functionality in SOA to research.

This launch page was designed for maximum flexibility. All reports are restricted to include only that information for which users are authorized.

Users can run the Statement of Account Financial Summary report for any fund by entering just the fund code. To run the report for a specific account, change the fund, organization, program, function and activity codes. To run the report for all your accounts, just select the period.

To view another report, select it from the drop down menu at the top of the page. The Transaction Detail Report has the ability to specify a range of object codes if desired.

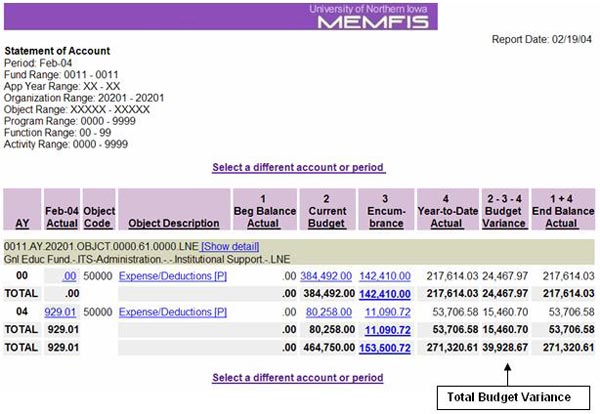

Statement of Account Financial Summary

Statement of Account - Financial Summary

This report can quickly give you the financial status of your account. It will also give you the beginning and ending fund balance (hint - you must enter only the fund to get these balances)

It is important to track the cash balance as well as the fund balance for Non-General Fund accounts. To find the fund balance information, run the Statement of Account Financial Summary report for the fund. An example of the output is displayed above.

To find your beginning Fund Balance:

- Locate the Unrestricted Net Assets row and the Beg Balance Actual column

- In the example above, the beginning Fund Balance is ($35,205) – note that positives are negatives and visa versa.

- Locate the Fund Balance figure at the bottom of the report (ex: $10,242.71).

- Here positives are positive and negatives are negative.

- Fund balance reflects the beginning Fund Balance plus YTD Revenues minus YTD Expenses and Encumbrances.

- As noted, users need to review this data in conjunction with Cash Balance (Cash & Cash Equivalents Ending Balance Actual – in the example above: $12,867.71)

Find your budget variance (free balance) for the account by running the Statement of Account, and locating the TOTAL Budget Variance number.

This report will provide a list of all net encumbrances. The report can be run from the e-Business Suite Reports menu, Funds Available for Viewing, or by clicking on the total encumbrance figure in the Statement of Account report.

- Can “drill down” on PO and Requisition numbers to get additional detail

This report provides an updated daily overview of account information including current budget, YTD encumbrances, YTD actual expenditures, and budget variance.

- Does not include “drill down” capability

This report provides a listing of the object codes used for a specific account and serves as a quick reference to account activity for cash balances, revenues and expenditures. The object code amounts on this report reconcile to those in the Transaction Detail Report. The report can be run by fund or specific account number for any period range.

Includes:

- Organization, Object Code, Object Description, Beginning Balance, Activity and Ending balance for Period specified

- No “drill down” capabilities

By fund, includes:

- Organization 00000 for local activity/non-GEF accounts

- Totals by Organization and Fund

By specific account, includes:

- Totals for Account

This report provides users with revenue and expense transaction details. While the user can define any period range, the report is typically run monthly and allows users the opportunity to review and verify all transactions for their accounts. The report is sorted by object code with totals for revenue and expense.

- Does not include budget and encumbrance information

- Can not expand across fiscal years

- Can run the report for any range of object codes

In order to run a Discoverer report, users must first determine two things:

1. Which responsibility?

- Financial – all financial responsibilities begin with FIN (example: FIN ITS Administration, FIN Biology, etc.)

- Human Resources – most human resources responsibilities begin with HR (example: HR ITS Administration Manager Self Service. Supervisor Self Service is also an HR responsibility.

2. Which report?

If you selected a FIN responsibility, you will be able to select from one of the following financial reports:

- Budget Detail Report

- Labor Distribution Report

- Payroll Expense Report

- Personnel Expenditures Report

If you selected an HR responsibility, you will be able to select from one of the following human resources reports:

- Actual Hours Worked and Hourly Rate by Organization

- Employee Listing by HR Organization

- Labor Distribution Report

- Student Assignment Approval Listing

Use your e-Business Suite password to connect to Oracle AS Discoverer and click GO.

Select the report wanted, enter the parameters for the report and click apply.

This report provides users with the current budget, including all Budget Adjustments posted to the General Ledger for the account.

- Two worksheets to choose from:

-Detail Report – includes:

-Budget Line #, Object Code, UID, Employee Name, Budget Line Description, HR Position Title, Appointment Status, Line Start Date, Line End Date, Line FTE, and Total Budget Amount

-Expanded View – includes separate columns for salary, fringe benefits and non-personnel budgets

- Snapshot Type is Daily

- Workbook Status is Active

This report shows how an employee’s wages were charged for each payroll snapshot selected or the daily snapshot can be selected. All employees have an assignment labor distribution schedule. Employees with element level schedules will appear in the Element Labor Distribution Worksheet. Examples include Summer Appointment or Special Compensation.

When this report is selected using a financial (FIN) responsibility, employees paid within the organization will be displayed. When this report is selected using an HR responsibility, employees within the HR org will be displayed, regardless of funding.

Both worksheets include:

- Employee name, assignment number, organization name, employee title, %, GL account code combination, and People Group

- Start date – the date the labor distribution schedule begins with the following exceptions:

-01-JAN-1951 – the date default schedules were defined for employee assignments

-31-OCT-2004 – the date assignments were converted from our Legacy system to Oracle

-01-JUL-2003 – the date Work Study defaults were defined

-Any other start date – the date the assignment started or the last date a change was made to the assignment

- End date – the date the labor distribution schedule ends with the following exception:

-31-DEC-4712 – indicates there is no end date defined for the schedule

-Any other end date – the date the LD schedule will end for the assignment.

- Also included in the Assignment Labor Distribution Worksheet:

-Type

-Default – indicates the organization labor schedule is being used

-Alternate – indicates a LD schedule has been set up different from the default

-Work study – used when student wages are to be charged to a work study account

- Also included in the Element Labor Distribution Worksheet:

- Reporting Name – the name of the element to be charged differently than the employee’s regular assignment.

This report reflects gross payroll amounts processed with each regular payroll.

- Two worksheets to choose from: biweekly and monthly

- Each worksheet includes:

-Effective date, GL account code, UID, assignment number, employee name, salary element, and distribution amount.

-Subtotals by object code.

-Totals by account.

This is a great report for reviewing salary savings. Personnel budgets, expenses and encumbrances for salaries and fringe benefits are reported by budget line number.

Two worksheets available:

- Summary

-Includes budget line number, employee name, object description, original budget, current budget, encumbrance, YTD actual, and line variance.

-“Drill down” capability exists to get monthly details.

- Detail line number

-Enter the budget line number to view the detailed budget, actual and encumbrance information about a specific budget line in a single account

-Include effective date and reference information.

Snapshot Types – select one of the following

- FY Budget

- Daily – current FYD activity

This report provides actual hours worked and the hourly rate for paydays selected. More than one payroll may be viewed by selecting a starting date and ending date.

Information in the report includes: organization, people group, UID, employee full name, current amount paid, hours worked (0 listed for salaried employees), hourly rate, earnings type, payroll date. This report can be used in conjunction with the Payroll Expense Report.

This report includes all employees that you supervise or that are in your department.

Includes:

- Employee #, University ID #, Vendor ID #, Employee Name, Timecard Assignment, Supervisor Name, Timecard Approver, Office location, and Student indicator

- Students who have e-Business Suite Financial responsibilities will be listed twice.

This report is provided by the offices of Student Financial Aid and Student Payroll and used at the beginning of the Fall semester to verify student assignments and hourly rates for returning student employees.

Information provided includes: University ID #, student employee full name, job title, assignment #, assignment description, hourly rate, increase rate amount, supervisor, and timecard approver.