Overview

The purpose of this page is to show how the UNI Blue Advantage (HMO) Plan works, who pays, and when. The below is an example of how the family plan works.

Self-insured Health Plans: 101

| Term | Definition | Amount |

|---|---|---|

| Copayment | A fixed amount you pay for a covered health care service, usually when you receive the service. | $10 for office, urgent care, and specialist visits |

| Coinsurance | Your share of the costs of a covered health care service after the deductible is met. This is calculated as a percent of the allowed amount for the service and will be owed until the max out-of-pocket is met. | 10% coinsurance |

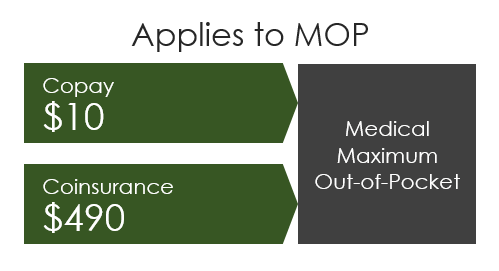

| Max out-of-pocket (MOP) | This is the most you could pay during a coverage period (one calendar year January - December) for your share of the cost of covered services. This limit helps you plan for health care expenses. Copays and coinsurance contribute towards your max out-of-pocket. Premiums, pre-service review penalties, and balance-billed charges, do not go towards your max out-of-pocket. | Medical MOP is $500 per person, with a maximum of $1,000 per family

The Prescription MOP is $1,000 per person, with a maximum of $2,000 per family |

| In-Network | Providers who contract with your health plan. Copayment may be less when seeking treatment from an in-network facility or physician. |

Service 1

After your nightly jog, you notice that your left knee is very sore and remains sore overnight. You decide to go to the doctor to make sure it is not anything more serious.

You elect to visit a specialist who is in-network, saving both you and the plan money, as Wellmark has negotiated maximum allowable prices for services with in-network providers.

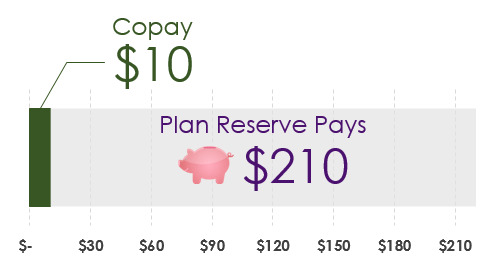

The total cost of the specialist is $220.

With the UNI Blue Advantage (HMO) Plan, there is a copay for specialist visits which is $10 (your responsibility to pay), and the plan reserve pays the remaining $210 (plan's responsibility to pay).

| Medical Max out-of-pocket

(MOP) |

Per

Person |

(Maximum)

Per Family |

|---|---|---|

| Beginning Balance | $500 | $1,000 |

| Specialist Copay | ($10) | ($10) |

| Remaining Medical MOP | $490 | $990 |

Service 2

It is determined that best treatment for the pain is arthroscopic meniscus repair surgery, a minimally invasive method to repair torn knee cartilage.

The surgery and recovery will take place at an in-network facility and Wellmark has negotiated maximum allowable prices for services with in-network facilities and providers.

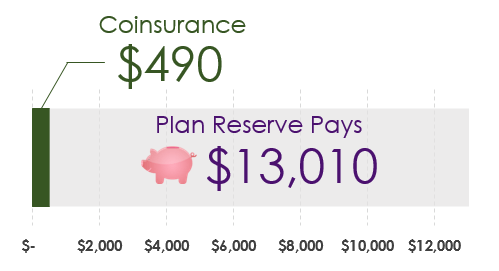

The total facility and surgeon fees are $13,500.

With the UNI Blue Advantage (HMO) Plan, payments not eligible for copays are covered by coinsurance and you share costs with the plan for the covered services. You owe 10% coinsurance of the facility and surgeon fees of $1,350 (10% of $13,500), up to the point you reach your per person medical MOP, and the plan reserve pays the remainder. However, because your MOP is $500 per person and you have already paid a $10 copay, you only owe the difference of $490 and the plan will pay $13,010.

| Medical Max out-of-pocket

(MOP) |

Per

Person |

(Maximum)

Per Family |

|---|---|---|

| Beginning Balance | $490 | $990 |

| Coinsurance | ($490) | ($490) |

| Remaining MOP | $0 | $500 |

Summary

These scenarios are designed to help you understand the phases of healthcare of the UNI Blue Advantage (HMO) Plan and payment at the different levels.

In these scenarios for the UNI Blue Advantage (HMO) Plan the copays and coinsurance all count towards meeting the annual medical MOP. The sum of these scenarios equates to your MOP expenses being $500 per person with a max of $1,000 for family, plus

the annual premium, and the plan reserve paid $13,220.

If you have additional questions on how the plans work, please contact the HRS Benefits team at

hrs-benefits@uni.edu.

The information displayed on this page is designed to help you make informed choices about your healthcare benefits. This information is not intended to be a guarantee of your costs or benefits. Your actual costs and/or benefits may vary. Refer to your health plan materials for information regarding your specific benefits and to determine covered medical and prescription expenses.